Trading Book Eba

Is this interpretation correct.

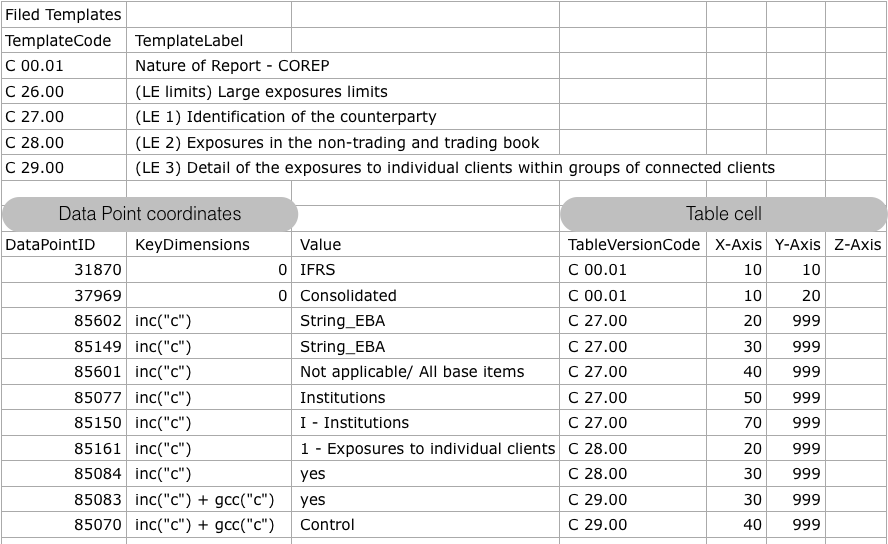

Trading book eba. Article 325 9 mandates the eba to develop draft rts to specify how institutions are to calculate the own funds requirements for market risk for non trading book positions that are subject to foreign exchange fx risk or commodity risk in accordance with the approaches set out in points a and b of paragraph 3. The european banking authority eba launched today a consultation on draft regulatory technical standards rts on how institutions should calculate the own funds requirements for market risk for their non trading book positions that are subject to foreign exchange risk or commodity risk under the frtb standardised and internal model approaches. Brussels 2 july 2020 the ebf has responded to the consultation paper on draft rts on the treatment of non trading book positions subject to foreign exchange fx risk or commodity risk of the european banking authority eba. The european banking authority eba launched today a consultation on draft regulatory technical standards rts on how institutions should calculate the own funds requirements for market risk for their non trading book positions that are subject to foreign exchange risk or commodity risk under the frtb standardised and internal model approaches.

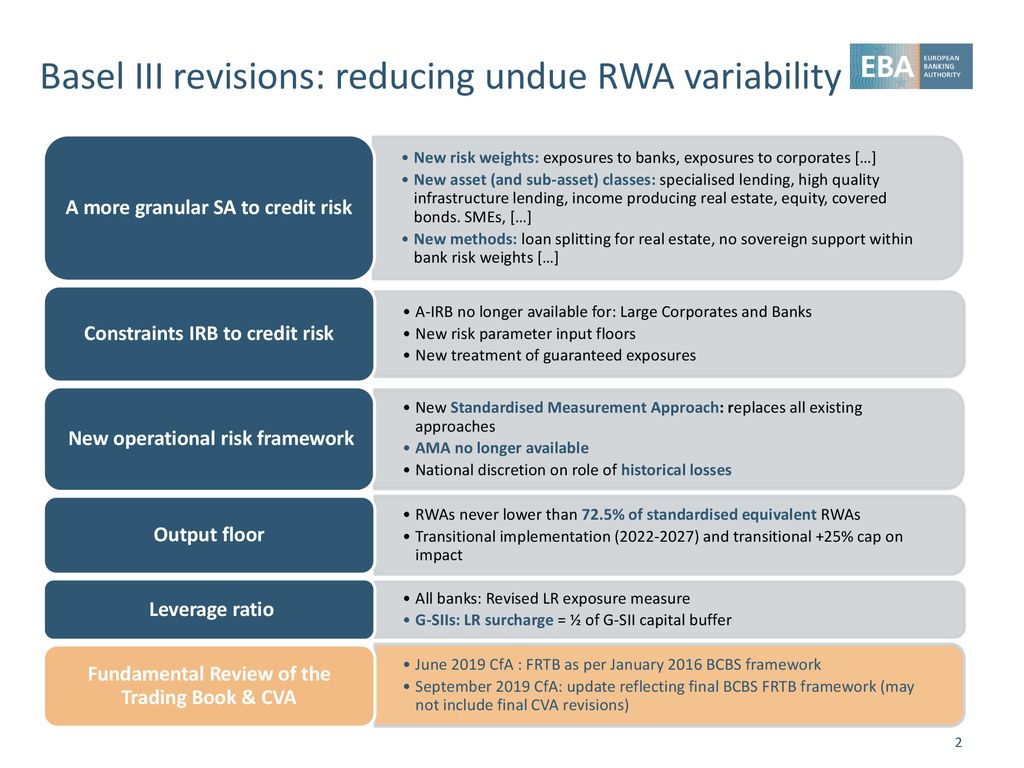

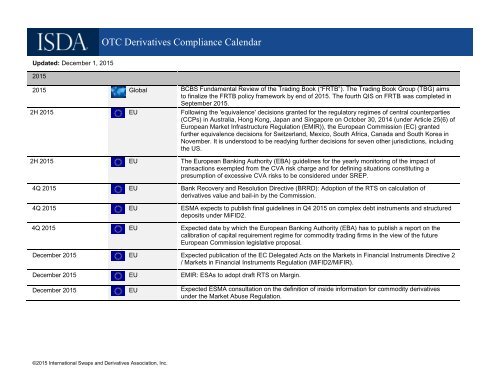

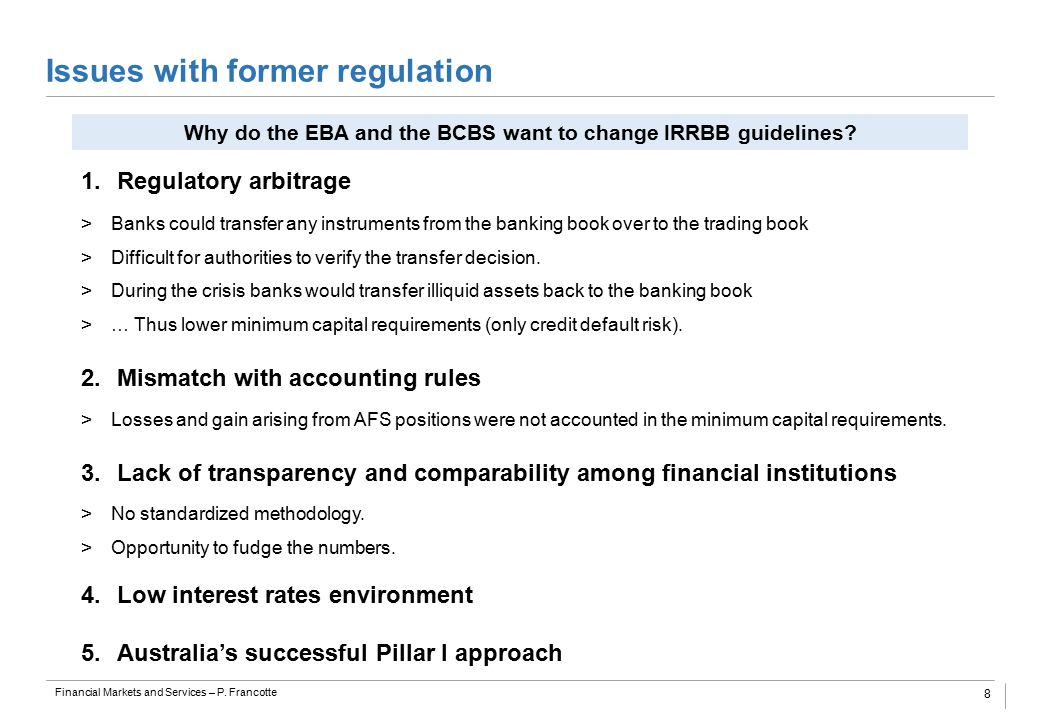

However the movement of an instrument from the trading book to the banking book requires supervisory approval. Traditionally trading book portfolios consisted. The starting point for the eba is all relevant changes in bcbs 457 which includes new and clearer criteria for determining the boundaries of the trading and banking books new definitions a new version of the standardised approach a revision of the simplified standardised approach and changes in the internal models approach ima. In addition the eba has decided to retain the minimum thresholds of 5 for individual currency and minimum of 90 of the total non trading book assets or liabilities for material currencies.

Trading book losses can have a cascading global effect when they hit numerous financial institutions at the same time such as during the long term capital management ltcm russian debt crisis. The eba plans to assess the impact of these changes and to publish regulatory technical standards after the finalisation of crd 5 crr 2. The fundamental review of the trading book frtb is a set of market risk capital rules designed to replace a series of patches introduced after the financial crisis. From a regulatory perspective market risk stems from all the positions included in banks trading book as well as from commodity and foreign exchange risk positions in the whole balance sheet.

Market risk can be defined as the risk of losses in on and off balance sheet positions arising from adverse movements in market prices. Per rbc25 16 if an instrument is re classified as an accounting trading asset or liability the switch from the banking book to the trading book can be automatic without supervisory approval.